irvine ca income tax rate

Irvine Tax jurisdiction breakdown for 2022. Property Tax in Orange County As California property tax rates go Orange County is on the low end at only 1061.

California Corporations Pay Far Less Than Nominal Tax Rate Orange County Register

The County sales tax rate is.

. Wayfair Inc affect California. The US average is 46. Contact pros today for free.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. This is the total of state county and city sales tax rates. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

So if your income is on the low side youll pay a lower tax rate than you likely would in a flat tax state. Irvine is located within Orange County CaliforniaWithin Irvine there are around 13 zip codes with the most populous zip code being 92620The sales tax rate does not vary based on zip code. The average cumulative sales tax rate in Irvine California is 775.

- Tax Rates can have a big impact when Comparing Cost of Living. The US average is 73. California CPA Corner Inc.

Income and Salaries for Irvine zip 92618 - The average income of a Irvine zip 92618 resident is 46989 a year. Ad Find affordable top-rated local pros instantly. 30 rows - The Income Tax Rate for Irvine zip 92618 is 93.

Tax Rates for Irvine - The Sales Tax Rate for Irvine is 78. The US average is 46. Did South Dakota v.

Compare the best State Income Tax lawyers near Irvine CA today. As calculated a composite tax rate times the market value total will provide the countys entire tax burden and include your share. The US average is 28555 a year.

Ad Stephen Son Inc Tax Return Preparation Bookkeeping Accounting Services Financial Services Website Directions 37 YEARS IN BUSINESS 3 YEARS WITH 949 336-1818 9070 Irvine Center Dr Irvine CA 92618 1. These figures are for the 2022 tax year. Californias notoriously high top marginal tax rate of 133 which is the highest in the country only applies to income above 1 million for single filers and 2 million for joint filers.

- Tax Rates can have a big impact when Comparing Cost of Living. 10 rows Sales Tax. Irvine is in the following zip codes.

Heres how taxes affect the average cost of living in Irvine CA. The California sales tax rate is currently. This is the total of state county and city sales tax rates.

Look up the current sales and use tax rate by address Data Last Updated. A combined city and county sales tax rate of 175 on top of Californias 6 base makes East Irvine Irvine one of the more expensive cities to shop in with 1117 out of 1782 cities having a sales tax rate this low or lower. What is the sales tax rate in Irvine California.

- The Income Tax Rate for Irvine zip 92618 is 93. - The Income Tax Rate for Irvine is 93. The California sales tax rate is currently.

Use our free directory to instantly connect with verified State Income Tax attorneys. Income and Salaries for Irvine - The average income of a Irvine resident is 43456 a year. The state of Californias income tax rate is 1 to 123 the highest in the US.

This includes the rates on the state county city and special levels. Irvine as well as every other in-county public taxing unit can now calculate required tax rates since market value totals have been determined. A combined city and county sales tax rate of 175 on top of Californias 6 base makes University Park Irvine one of the more expensive cities to shop in with 1117 out of 1782 cities having a sales tax rate this low or lower.

The Irvine sales tax rate is. 10 rows Sales Tax. 775 The total of all sales taxes for an area including state county and local taxes Income Taxes.

Irvine CA Sales Tax Rate Irvine CA Sales Tax Rate The current total local sales tax rate in Irvine CA is 7750. 92602 92603 92604. The December 2020 total local sales tax rate was also 7750.

The minimum combined 2022 sales tax rate for Irvine California is. A combined city and county sales tax rate of 175 on top of Californias 6 base makes Irvine one of the more expensive cities to shop in with 1117 out of 1782 cities having a sales tax rate this low or lower. If taxable income is over.

Income and Salaries for Irvine zip 92618 - The average income of a Irvine zip 92618 resident is 46989 a year. The US average is 28555 a year. - The Median household income of a Irvine zip 92618.

Income Tax Rate in Irvine CA About Search Results Sort. Sales Tax Breakdown Irvine Details Irvine CA is in Orange County.

Irvine California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How Is Rental Income Taxed In California

Understanding California S Property Taxes

What Are California S Income Tax Brackets Rjs Law Tax Attorney

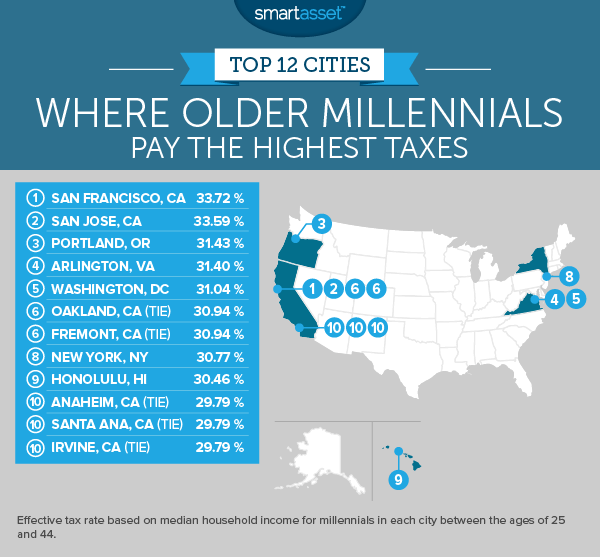

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

Irvine California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

California Housing Market Report 2022

Where Residents Are Most Likely To Pay State And Local Taxes Smartasset

California Corporations Pay Far Less Than Nominal Tax Rate Orange County Register

What Are The Basics Of U S International Taxation

Section 962 Election Of The Corporate Tax Rate By Individuals Trusts And Estates For Global Intangible Low Taxed Income Gilti Income Inclusions Thomas Ppt Download